A Trial Balance And Balance Sheet Will Assist You Gain Financial Knowledge.

Good financial management is essential to a company’s success. It is important for planning, organizing and controlling company’s financial resources to achieve strategic goals.

The balance sheet and trial balance are two of the most important tools for analyzing a company’s finance. Although different records serve different functions, understanding how they interact will help improve your financial literacy and decision-making process

What Is A Trial Balance?

A trial balance is an internal financial report that reflects the current changes balance of all general ledger account. Its is usually completed the end of the accounting period, such as month or year, and ensures the accuracy of company’s accounting. In double-entry bookkeeping, a trial balance ensures that all debits equal the total credits.

The Trial Balance Consists of Three Primary Columns:

The account name lists all general ledger accounts, including cash, inventory, and accounts payable. It shows the account balances that are frequently debited, indicating assets and expenses. Account balances are usually shown with a credit balance, indicating liabilities and income. Although a trial balance checks for errors in the accounting system, it does not provide a comprehensive picture of a company’s financial position.

Want to learn about the next steps for growing your business ?

What Is a Balance Sheet?

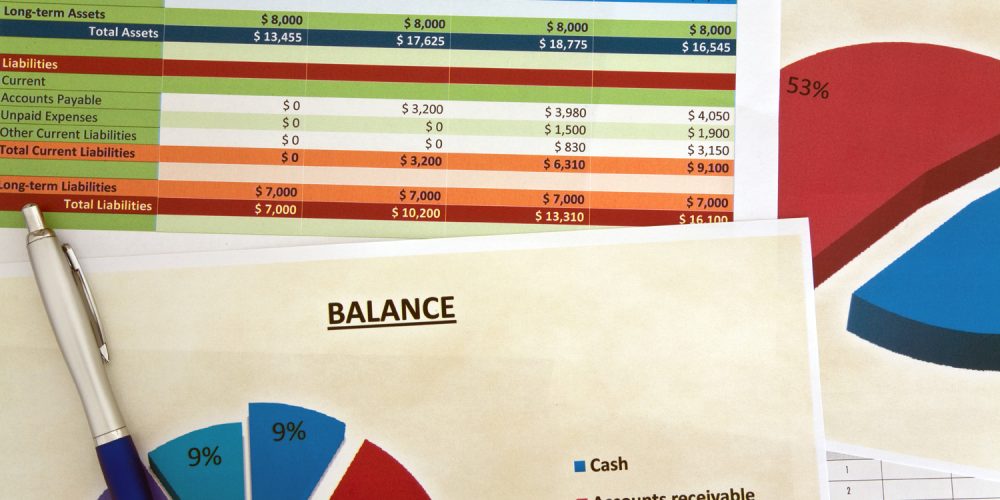

A balance sheet is a financial document that reflects a company’s financial position as of a specific date. A balance sheet is distributed to third parties, including creditors and investors, unlike a trial balance, which is used internally. Following the accounting equation, add up the company’s assets, liabilities, and equity.

Assets = Liabilities + Equity.

The term “balance sheet” refers to an equation that is always balanced. It provides information about the overall financial health, solvency and liquidity of a company. The balance sheet includes the following items:

A Balance Sheet Has Three Fundamental Parts:

A company’s assets include cash, assets, and real estate. Assets are divided into two categories: non-current (long-term investments and property) and current, which are converted to cash within a year.

A company has two liabilities: accounts payable and loans. Like assets, liabilities are also classified as non-current (due in one year) or current (due within one year).

After subtracting liabilities from assets, equity represents the owners’ stake in the company. It includes items such as retained earnings and common stock.

Main Differences Between Balance Sheet and Trial Balance

Both the balance sheet and the trial balance are essential in financial management, although they perform different functions.

A trial balance is a process used to ensure that debits and credits match, thus verifying the accuracy of accounting data. Internally, it detects and corrects any accounting errors. On the other hand, a balance sheet is a formal financial statement that provides internal and external stakeholders with a comprehensive view of a company’s financial position.

A trial balance simply displays all the general ledger accounts and their individual balances without providing any information about the company’s financial position. A balance sheet, on the other hand, summarizes a company’s financial position with a focus on assets, liabilities, and capital.

A trial balance, which is usually prepared monthly or quarterly, helps ensure the accuracy of your accounts. A balance sheet, on the other hand, is usually prepared at the end of a fiscal year or quarter and provides a summary of a company’s financial position.

While a balance sheet condenses data to highlight key financial figures, a trial balance includes a complete list of accounts and their balances.

Combining Balance Sheets And Trial Balance

Combining the trial balance and balance sheet will provide you with the most accurate view of your company’s financial health.

A trial balance is used to identify discrepancies in accounting data before compiling financial statements. An imbalance in the trial balance indicates an error that needs to be corrected before completing the balance sheet.

A balance sheet provides a more complete picture of your financial position, while a trial balance ensures the accuracy of your accounts. Reviewing both frequently ensures that your business remains financially sound.

Accurate trial balance data and high-level balance sheet insights enable you to make better decisions. Whether you’re planning expansion, debt management, or new investments, both studies provide the information you need to make sound decisions.

While the balance sheet can guide long-term decisions, ongoing monitoring of your trial balance allows you to stay on top of day-to-day transactions. Insights into asset development, liability patterns, and equity changes on the balance sheet will lead to critical decisions for the company, such as reducing debt or reinvesting dividends.

Conclusion

Although the balance sheet and trial balance have different purposes, they are both important tools for financial management. The trial balance ensures that debit balances equal credit balances, which helps confirm accounting accuracy. In contrast, the balance sheet provides a comprehensive view of your company’s financial health. These documents, when examined together, will help you better understand your company’s financial position. Combining the two will allow you to identify failures early, make wise decisions, and better prepare your organization for the future. Examining your balance sheet and monitoring your trial balance on a regular basis will help you improve financial accuracy and support more effective organizational expansion and planning.