Effortlessly Navigate Tax Season with Our Tax Compliance for Small Businesses

Our professionals ensure accurate year-end financial statements, so your taxes are filed on time and with precision—giving you peace of mind.

FEATURES

What’s Included in Our Small Business Tax Solutions

Corporate Tax Returns

Maximize your returns. Our accurate filings and expert tax strategies ensure you keep more money and build a stronger financial foundation for your business.

Sales Tax Management

Sales tax made easy. We handle filings on time and accurately, freeing you to focus on what matters – growing your business.

Small Business tax advisory

Tax planning and strategy, not just filing. Our experts go beyond forms, providing proactive guidance to optimize your tax position and empower smarter financial decisions.

State Income Tax Filings

Go beyond compliance. We minimize liabilities and find maximum deductions, boosting your bottom line and financial health.

Why choose

Accountipro

for Business Tax Preparation

Qualified & Trained Accountants

Our experienced professionals ensure your taxes are prepared accurately, in full compliance with the latest regulations.

Industry-grade

Technology Stack

We leverage advanced tools to streamline the tax preparation process, enhancing precision and efficiency.

Cost-effective

Solutions

Our affordable tax services deliver exceptional value without compromising on quality.

Scalability

Our flexible services grow with your business, adapting to your evolving tax preparation needs.

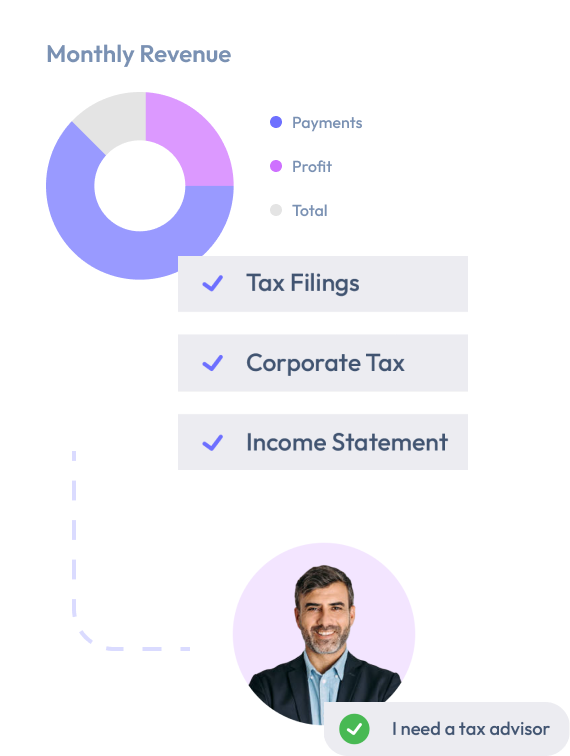

MORE CONTROL WITH OUR TAX COMPLIANCE SERVICE

Accurate books make it easy to swiftly navigate tax season with timely tax filings.

By efficiently managing your business finances, our expert tax advisors assist you to easily navigate tax season, giving you back your valuable time.

SIMPLIFY TAXES WITH OUR BOOKKEEPING EXPERTISE

Accurate books all year ensure smooth and easy tax preparation

By maintaining accurate and up-to-date books, our bookkeeping services help you stay prepared for tax season, saving you time and ensuring compliance.

CLIENT FEEDBACK

We have promised results,

and we have proven them

CLIENT FEEDBACK

We have promised

results,

and we have

proven them.

CLIENT FEEDBACK

We have promised

results,

and we have

proven them.

We scale with you - We’re a full-stack accounting firm

number-crunchers.

Our Certifications & Affiliations

FAQs

Tax preparation services offer accuracy, ensure compliance with tax laws, maximize deductions and credits, save you time, reduce stress, and provide expert guidance. They also offer year-round support for ongoing tax-related needs.

AccountiPro provides tax preparation services designed to simplify your tax filing process, but please note that we are not a public accounting firm and do not offer services that require a public accountancy license. Instead, we utilize third-party tax preparation platforms like TurboTax to file your taxes on your behalf.

- Authorization: To begin, you must complete a valid Taxpayer Disclosure Authorization. This document allows us to access and handle your tax information. We will not proceed with tax preparation until this authorization is in place.

- Information Gathering: Once authorized, you will provide us with your tax-related documents and information. These can include income statements, deductions, credits, and other relevant financial data.

- Preparation and Filing: We use third-party services, such as TurboTax, to prepare and file your tax return. These platforms help ensure accuracy and compliance while handling the technical aspects of the filing process.

- Third-Party Engagement: Please be aware that AccountiPro may engage third-party tax preparers to fulfill your tax filing requirements. Any disputes or issues related to the tax filing will need to be addressed directly with the third-party preparer, as AccountiPro assumes no liability for filing errors.

- Completion and Follow-Up: Once your tax return is filed, we provide you with a copy and assist with any follow-up questions or concerns you may have.

You can file business taxes on your own if you’re aware of the tax filing process, or you can simply enjoy streamlined and optimized business tax preparation services by working with AccountiPro. If you’re interested in learning further about our tax preparation and filing services, please feel free to schedule a consultation call with our experts to get started.

Federal tax forms to file taxes for your businesses vary according to their specific structure and size. Here are the respective federal tax forms based on their business type:

- Sole Proprietor: Schedule C (Form 1040)

- C-Corporation: Form 1120

- Foreign Corporation: Form 1120 F

- S-Corporation: Form 1120S

- Partnership: Form 1065

- LLC Filing as a Sole Proprietor: Schedule C (Form 1040)

- LLC Filing as a Partnership: Form 1065

- LLC Filing as an S-Corp: Form 1120S

- LLC Filing as a C-Corp: Form 1120

For further details, please contact our tax consultants for a free tax consultation.

All businesses must file tax returns and pay both state and federal taxes on their income. If your business is not tax-compliant, you may face significant penalties from the government. These may consist of penalties, fines, or further serious consequences. Being non-compliant can also harm your business’s reputation in the industry and make it difficult for you to obtain loans or acquire investments.

Even though each business structure and industry has its own tax requirements, all business owners need to ensure complete compliance with tax laws and regulations and remain updated with them.